By Jariatu S. Bangura

Parliament last week approved the 2025 Finance Act, maintaining the 5% import duty on rice to support revenue mobilization efforts.

Despite earlier debates, the additional 5% tax increase will now take effect in 2026 instead of 2025, as was initially outlined in the 2024 Finance Act.

Opposition MPs had previously called on the government to either remove the 5% tax or retain it to ensure the success of the Feed Salone project, which aims to bolster food security across the country.

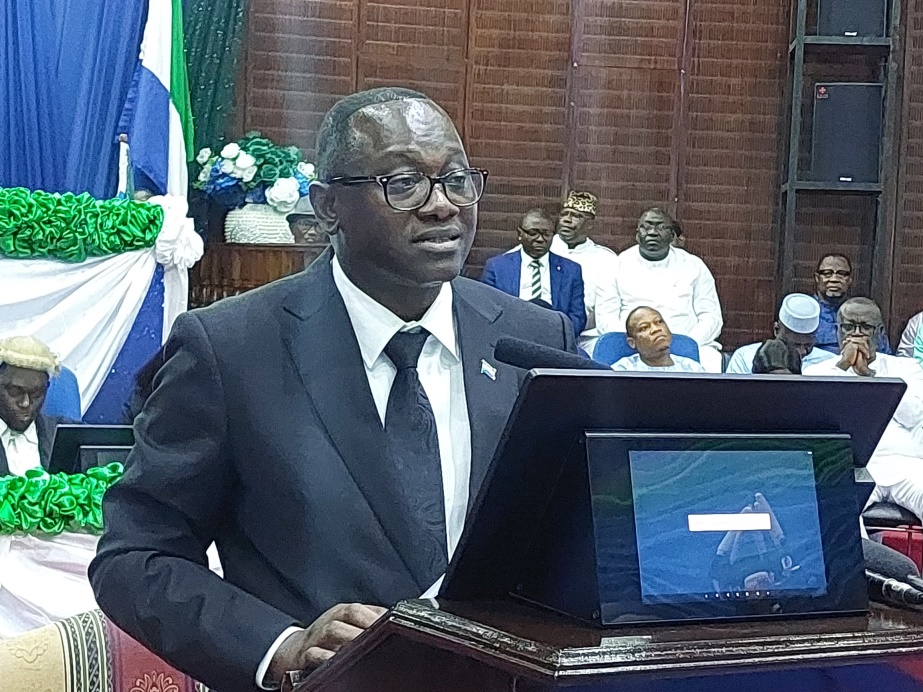

Finance Minister Sheku F. Bangura clarified that the new Act does not introduce any new taxes but seeks to strengthen tax mobilization. He noted that it aims to provide a framework for imposing and adjusting taxes to implement the government’s financial policies beginning in 2025.

The Act includes revisions to the Harmonized System (HS) code, adjustments to royalty fees, and measures to improve tax enforcement. It also prohibits corporate tax for certain entities and introduces provisions for international non-governmental organizations.

Opposition MPs described the bill as largely beneficial, emphasizing its lack of new tax proposals. However, they criticized the lack of robust research and preparatory documents from the Parliamentary Budget Office, which they argued left lawmakers inadequately informed during debates on critical bills.

Hon. Daniel Koroma, the Deputy Leader of the Opposition, voiced concern over the impact of the Act on vulnerable districts, stating, “Bonthe is the hungriest and most disadvantaged district in Sierra Leone.”

Deputy Speaker Hon. Ibrahim Tawa Conteh countered by urging MPs to embrace the Feed Salone initiative, stating, “Every country must manage and improve its population. We should embrace Feed Salone holistically.” He also criticized inefficiencies in the Ministry of Agriculture, alleging that some officials undermine food security agendas.

The 2025 Finance Act primarily reinforces existing tax regulations and enforcement mechanisms rather than introducing new taxes. Lawmakers urged relevant ministries to ensure its provisions are effectively implemented to achieve the desired impact on revenue mobilization and national food security.